Mar

Post TRIM and the New Definition of Default – What’s been keeping us busy?

We were privileged to have been invited to the recent PwC ‘Inspiring Credit Risk Modelling’ conference in Frankfurt, a hugely informative and thought provoking two day event.

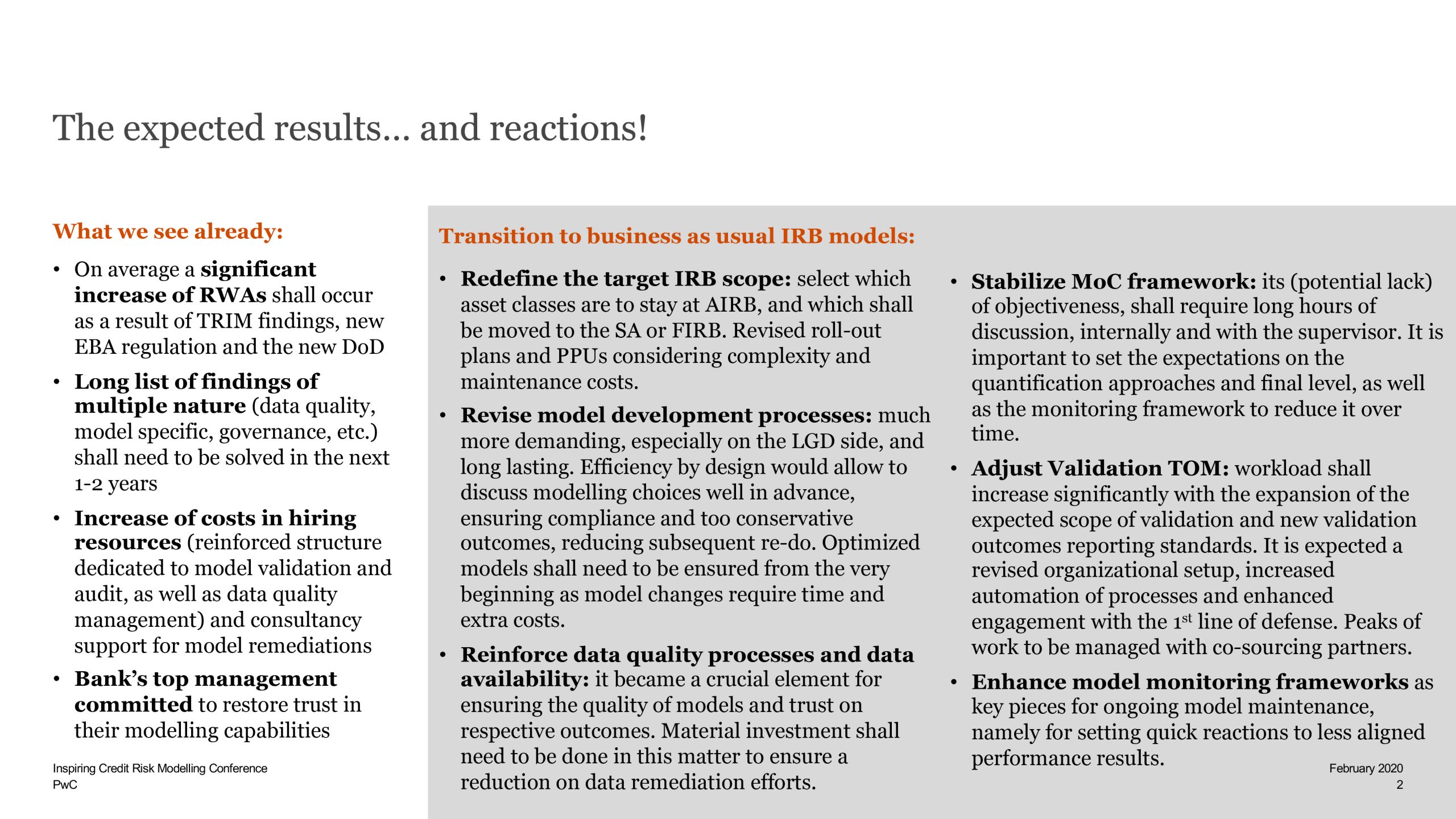

The following two slides from the guys at PwC Frankfurt – ‘Hot topics of the moment for an IRB bank’ – succinctly outline the recent TRIM initiative and the current ‘New Definition of Default’, together with the associated timelines, plus wide ranging considerations arising from each:-

Quantribute were hugely successful in providing banks and consultancies with expert Quantitative Credit Risk resources to help successfully push TRIM over the line and are now deeply entrenched in doing the same with projects all over Europe. These are predominantly regulatory driven with very stringent deadlines and stemming from the ‘New Definition of Default.’

If you are a bank or consulting firm seeking exclusive access to elite freelancer Credit Risk Quant professionals to meet regulatory demands and deadlines then get in touch.

Let’s Quantribute!

Sorry, the comment form is closed at this time.